Build your own home — grand designs for beginners

by Lindsay Cook

(www.ft.com)

I blame the Channel 4 programme Grand Designs. Like tens of thousands of others, I have built my own home. It cost more than I planned, took longer than expected and ended with an acrimonious visit to a lawyer. However, like childbirth, the pain was worth it. We have the home of our dreams with space, light and two dishwashers.

Yet I should have heeded the warning signals. In the 18 years that Grand Designs has been on the air, the nation has thrilled to the sight of scores of design-stricken couples impoverishing themselves and jeopardising their mental health in quests to build ideal homes on less than ideal sites.

In the latest series, one couple was forced to borrow from family members when they found their new country home with a view could not be connected to the electricity or water supply without spending an extra £40,000 to dig a long trench in the road. In Hertfordshire, a developer (who should have known better) spent six years fighting the planners and another four years building his Roman villa-inspired home. Costs over the 10 years rose from £600,000 to an estimated £2m.

These tales of woe appear not to be putting people off. Self-builders now account for almost 10 per cent of private new-build homes in the UK. But there are a number of rules of thumb that can help smooth a home’s construction — or prevent an oversight from turning into a catastrophe.

Be prepared

Most self-builds, it must be said, have relatively modest designs. The reason, according to James Blair, of the Self Build Mortgage Shop in Hertfordshire, is that the ambitious telegenic schemes we know and love would never get finance from mortgage lenders. Self-builders need outline or full planning permission to get initial funding. They also need a professional project manager, detailed costings and a builder that has been credit-searched and recommended.

It takes a lot of patience and a large deposit for self-builders to qualify for a mortgage. They also need to build a home that can easily be valued, not a one-off masterpiece made from shipping containers on a steep slope with restricted access. They must also have enough cash to cover delays in the “stage payments” that mortgage lenders release to fund construction and expensive rates of interest during the build.

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/e795f126-bb16-11e7-bff8-f9946607a6ba

I knocked down an existing house and started from scratch. There are tax advantages to building a new home instead of extending an existing one. New self-builds qualify for rebates on VAT. Kevin McCloud, the Grand Designs presenter, estimates that the typical cost of building your own home is £1,500-£2,000 per sq m — if you stick to your original design and specification. Changing plans can cost you dear.

In 2011, as part of its Housing Strategy for England, the government announced that it expected to double the number of self-built properties, with 100,000 to be completed by 2021. Legislation in 2016 included several measures to facilitate self and custom build, placing a duty on councils to allocate land.

Under the Housing and Planning Act, local authorities should consider how they can best support self-build. They must give development permission to enough suitable serviced plots of land to meet the demand for self-build and custom housebuilding in their area within the next three years. The level of demand is established by how many people register for the right to build in a year. The first “base period” finished at the end of last month.

Councils vary in their willingness to help self-builders: a report on the sector by Research found local authorities in the Northeast and West Midlands were most helpful to self-builders.

According to AMA Research, the biggest problems for self-builders are the availability of land, getting planning permission and accessing funding. Most self-build properties are high-specification detached homes — and a key growth area is home automation, intelligent houses that made it easier to co-ordinate solar panels with the use of appliances such as dishwashers and washing machines, ensuring that they only came on when the sun shines.

Borrowing to build

Self-builders need more money up front than conventional homebuyers. They usually have to buy their building plots and fund their planning applications before they can get loans.

Mortgages for self-builders tend to be interest-only. They work like an overdraft: the borrower pays interest when money is drawn down at the completion of each stage of the build. Cheap fixed-rate loans tend not to be available during the building process and there can be hefty exit fees imposed on borrowers who change loans when the work is completed. Self-build interest rates are typically more than 5 per cent.

Self-builders should expect to take as long as six months to get their finance in place and have 25 per cent of the cost of the land and building materials upfront. Before they can apply for a mortgage, they also need to have full or outline planning permission. When the building is completed some self-build lenders will automatically offer a lower-rate conventional mortgage.

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/e795f126-bb16-11e7-bff8-f9946607a6ba

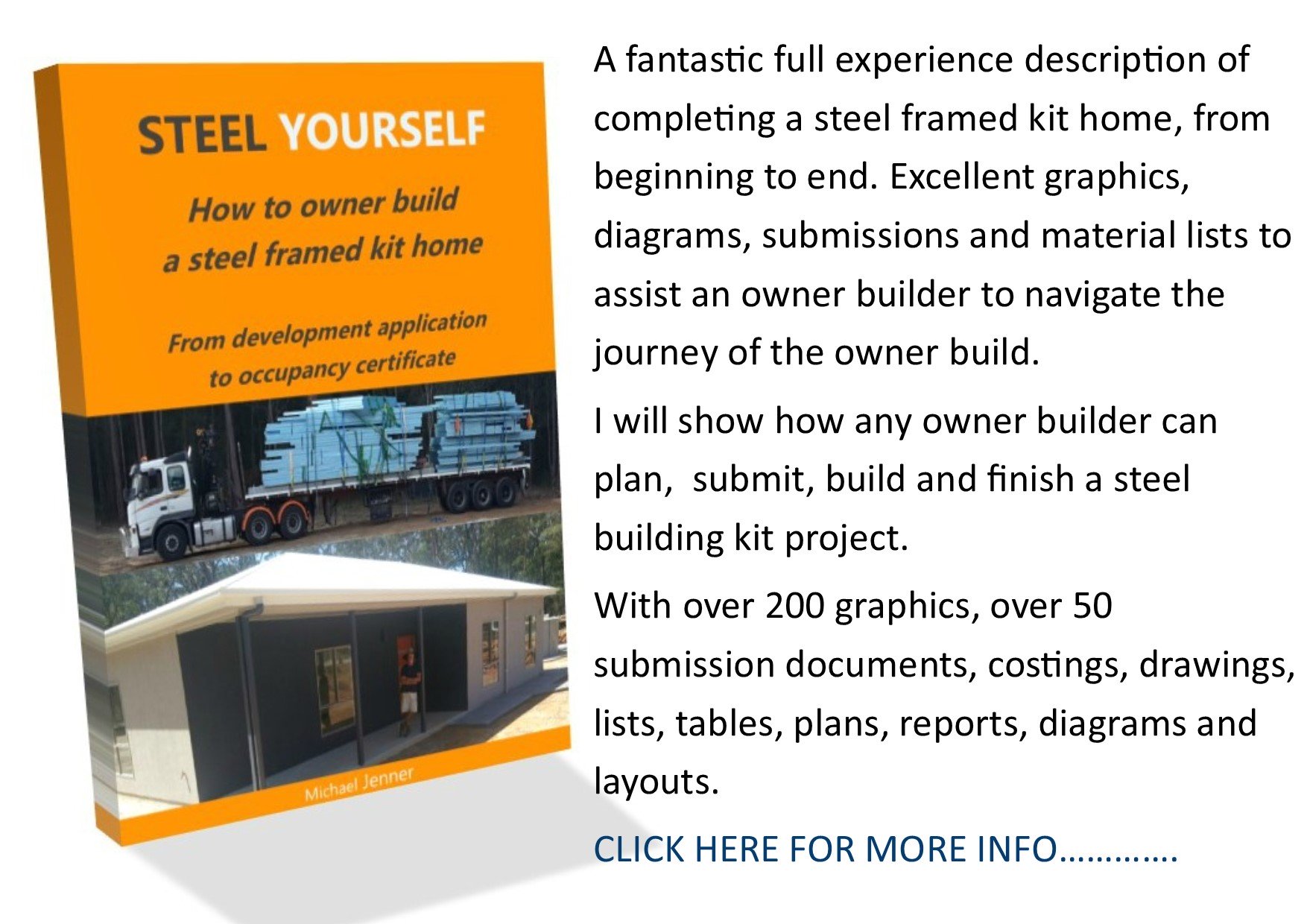

Lenders are guided by valuers because they do not want to lend on a property that is worth less than the loan. They need market evidence of the resale values of the properties they are about to build. This is especially true of prefabricated buildings and “kit” houses; they will ask for documented evidence of their long-term structural integrity and longevity.

Most self-builders use brokers to find their loans. Mr Blair of the Self Build Mortgage Shop said: “Getting a loan is like pulling teeth now. It takes three to four months to get a decision in principle on the mortgage. It takes a minimum of £5,000 just to get the mortgage with lender’s fees, arrangement fees, valuation fees and planning permission.”

At the outset, he sends potential clients more than 100 questions, including some on their spending and income. He receives new inquiries every day, but often he does not hear from the clients for another 18 months as they search for plots, builders and architects.

Mr Blair finds very few self-builders near to London because land prices are too high. “The land in the south-east is too expensive . . . It is all about affordability just like an ordinary mortgage.”

Some lenders are deterred by the higher costs and risks, and the relatively small volumes of business, according to industry body UK Finance. “Some firms offering self-build mortgages are smaller regional lenders, so some borrowers may find it difficult to research the market. But, as with other forms of mortgage lending, prospective borrowers can use a broker to help them identify potential sources of funding,” it says.

Ray Boulger at mortgage broker John Charcol says self-build interest rates are higher to reflect the greater administration costs. Each stage payment includes the cost of a re-inspection — and there can be as many as seven drawdowns over the course of a project.

“However, the additional cost in terms of fees and interest rate is normally significantly less than the increase in value of the property when completed compared to the cost of the land, building and professional fees,” he says.

Finding a plot and getting permission

Registering for the Right to Build with a local authority should eventually make it easier to find a plot but many self-builders resort to estate agents. There are few plots with planning permission for sale but agents should have properties on their books that are suitable for demolition and redevelopment. This means that buyers pay a premium compared with building land (as well as the costs of demolition) but they should find it easier to get planning permission. Plotfinder.net, a website, collects information from people selling plots and from estate agents, making it available to subscribers.

Go here for the end of the story...

www.ft.com/content/e795f126-bb16-11e7-bff8-f9946607a6ba

Join in and write your own page! It's easy to do. How? Simply click here to return to News portal.